YC and B2B

by Alex MacCaw

Investors traditionally go for startups that shoot for the stars, banking on a big return from a few companies in their portfolio. On the surface of it, you might think that these returns would come from consumer companies such as Spotify or AirBnb. They get a disproportionate amount of coverage from the tech press, and are often all or nothing. The successful ones are very successful—no doubt about that.

However there are a significant number of small business-to-business (B2B) startups quietly churning away generating profits and good returns for their investors. In fact, 80% of the tech IPOs in 2013 aimed their products at businesses, rather than consumers. The inconvenient truth is: if you run a B2B startup you're more likely to succeed.

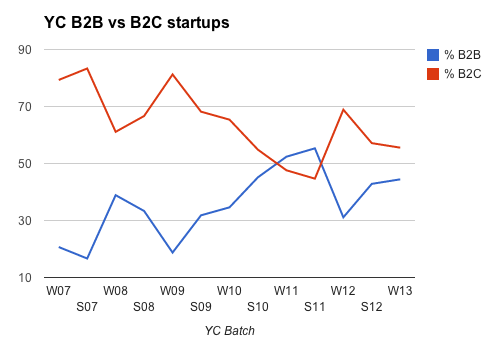

Some investors are leading this trend; roughly 40% of the last two YC batches were B2B. I went through every batch and categorized startups into either B2B or consumer markets, and while the data I have is incomplete, it's still useful at an aggregate level.

What's really interesting though is the longterm trend. YC are funding more B2B startups today than they were a few years ago. It may not be as sexy as some of the hot consumer startups, but the probabilities are better. It'll be interesting to see what percentage of the W14 batch are pitching their services to businesses.